Online payment management & reporting tools

Set up regular reports, view and search your transaction history, process refunds and more.

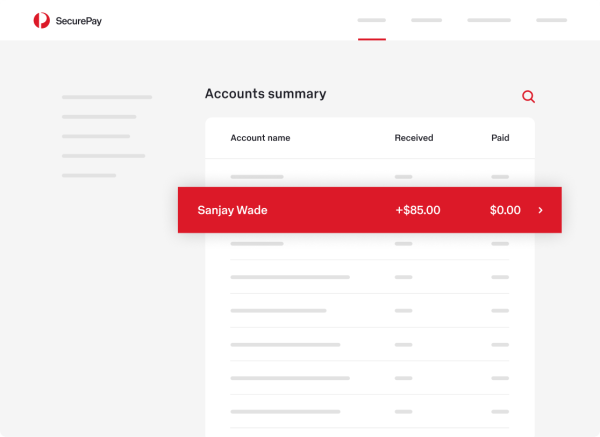

Stay on top of transactions

With a simple reporting tool and user-friendly interface, SecurePay helps you to easily track all your transactions, set date ranges and search specific online payments.

Manage user access and permission via roles

Store and manage customers and tokens

Reconcile your payments to your bank account

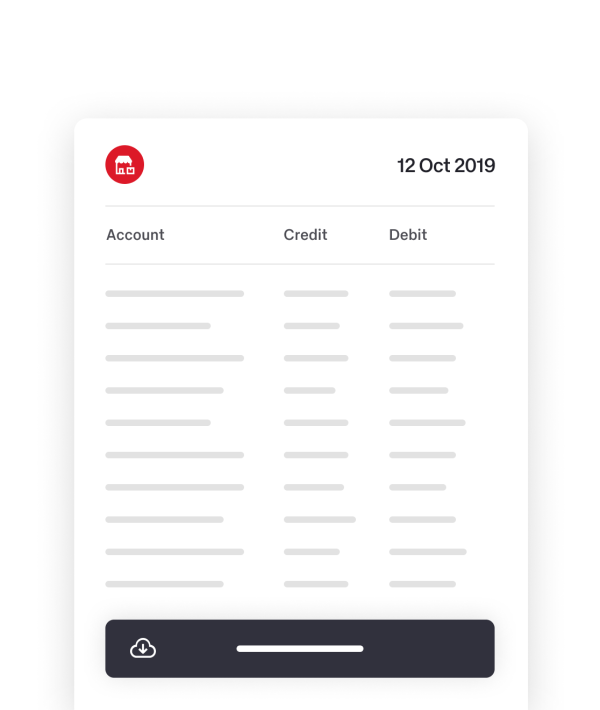

Set up simple regular reporting

Download regular, customisable reports to get a more detailed view of your business transactions and progress.

" We always find SecurePay's reporting to be accurate and it balances with our accounts department each month. "

James Rowett, Tennis Australia

Ready to start accepting payments?

What are online payment tools?

Online payment tools refer to digital platforms and services that enable your businesses to make financial online transactions. These tools have revolutionised the way we handle payments, offering convenience, security and efficiency. Online payment tools cover various technologies that facilitate the transfer of funds between customers and businesses.

Common types of online payment tools include the digital wallet or e-wallet, which stores a user's payment information and allows them to make purchases, pay bills or transfer money with just a few clicks. Another widely used tool is the payment gateway, a service that securely processes credit and debit card and other transactions, ensuring that sensitive information is encrypted and protected.

The rise of online payment tools has not only transformed the way we engage in everyday transactions but has also allowed the growth of ecommerce businesses by providing a secure and convenient way to shop online. Online payment tools have become an integral part of the digital landscape, helping you to manage your finances, make purchases and transactions with ease.

How do online payment tools work?

Online payment tools leverage various technologies and protocols to create secure and efficient financial transactions online. The process typically involves several steps:

Initiation & data entry: The customer starts making a payment by selecting items to purchase on a website. They then proceed to the checkout or payment page and enter their payment information. This could include credit or debit card details, bank account information, or credentials for digital wallets like Apple Pay.

Encryption & security: Once the payment information is entered, it is encrypted and runs through a selection of data protection methods, such as fraud detection and global online security standards. Online payment tools require extra layers of cyber security to ensure sensitive financial data is handled safely and accurately.

Authorisation: The encrypted payment information is sent to the payment processor or gateway. The payment processor verifies the validity of the payment details, checks for available funds, and confirms if the transaction can proceed. This step often involves communication with the user's bank or card issuer.

Payment processing: Once the online payment is authorised, the payment processor processes the transaction. If the payment is successful, the processor sends a confirmation to the merchant or service provider.

Funds transfer: The funds from the customer’s account are transferred to the merchant's account. This transfer can happen within seconds, depending on the payment method and the involved financial institutions. The user then receives a confirmation of the successful payment.

Settlement: The merchant's account is credited with the payment amount, minus any applicable fees. The funds may be settled daily, weekly or according to the merchant's agreement with the payment processor.

Reporting & reconciliation: Merchants and customers can access detailed reports of their transactions through the payment tool’s dashboard. This helps in tracking sales, managing inventory and reconciling financial records.

Setting up simple reporting with SecurePay

Setting up your own online payment reporting tool with SecurePay offers many benefits for managing your payments and financial transactions effectively. Our account management reporting gives you a clear overview of your payment transactions. You can track sales, revenue and other financial metrics in real-time, enabling you to make informed decisions about your business.

Using SecurePay’s easy-to-navigate interface, you can set date ranges and customise your reports to help you identify trends and areas for improvement. Get a more detailed understanding of your business transactions and progress through regular reporting. Having access to your historical transaction data, it’s easier to make more accurate financial forecasts and predictions. This can be useful in budgeting, resource allocation, growth planning or goal setting for your business.

Analyse transaction data and gain better insights into your customer’s behaviour, store and manage tokens or search for specific payments. You can also streamline the process of reconciling your financial records and compare the data from the reporting tool, ensuring accuracy and identifying any discrepancies.

SecurePay’s simple reporting tool centralises your payment and financial data all in one place. Implementing an online payment reporting tool empowers you to manage your financial transactions with precision, gain valuable insights and optimise your business operations.