Online payments

For everyday online payments

Take payments online, view detailed reports and access local support.

- Great for once-off transactions

Allow your customers to make scheduled once-off payments - Detailed reporting

Set up regular reports, view transaction history and more with SecurePay's portal - Top grade digital security

PCI compliant and award winning security/anti-fraud solution - Simple set-up and integration

We will work with any website type and provide detailed documentation - Local Australian support

Our Melbourne based support team are here to help 8am to 8pm Mon-Fri - Customisable card payment UI

Maintain total control of your customer checkout experience

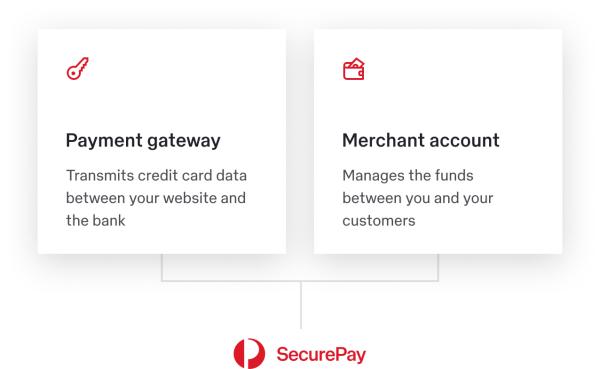

A complete solution for online payments

In order to process payments online you will need a payment gateway as well as a merchant account. SecurePay offers both, removing the hassle of finding a merchant account. SecurePay are partnered with NAB to provide the merchant account 1.

Already have a merchant account? No problem! Check out our Payment Gateway only solution.

Multiple payment methods to suit every customer

SecurePay is compatible with all major credit cards and PayPal, giving your customers a flexible payment experience. Use a safe way to accept online payments and choose from a wide range of payment methods for your business.

Grow your business by providing more payment options

SecurePay's Dynamic Currency Conversion solution allows your international customers to pay in their own currency with a transparent exchange rate that is locked in at the time of their transaction.

World class security

SecurePay lives up to the current global standards of online security, keeping you and your customers' financial and personal details safe. Following up-to-date global security protocols, accepting online payments and making everyday transactions secure and protected from unwanted access.

Advanced fraud protection

Once you've set the rules, FraudGuard screens your transactions for you so you can get on with business.

OAuth 2.0

OAuth 2.0 is the current universal standard of online security when it comes to safeguarding your credentials.

PCI v3.2 compliant

SecurePay is fully PCI DSS compliant, protecting the security of your customers credit card data.

1.6% + $0.30 AUD

Domestic cards

Fees include GST.

3.4% + $0.30 AUD

International cards

Fees include GST.

Simple & transparent pricing

No hidden fees or set costs - you are charged per transaction making the SecurePay pricing model straightforward.

Easily integrate with third-party providers

Getting started with SecurePay is quick and easy, working with any website type and providing detailed documentation as well as local support.

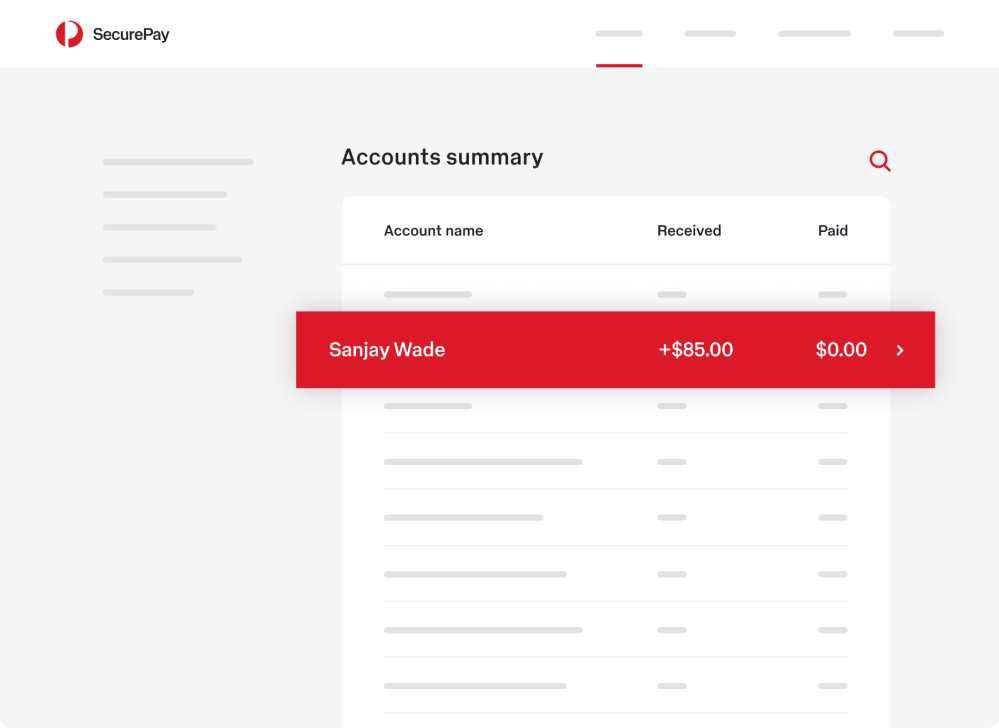

Dedicated dashboard to help you manage your payments

Simple reporting shows each and every transaction under the microscope, giving you a complete view of your transaction history.

Explore our other products

Ready to start accepting payments?

Accept online payments for your business

Whether you are a small business owner or manage a large ecommerce store, accepting online payments has become an important aspect of running a successful online shopping experience. To create a seamless user journey for your customers, it's essential to offer convenient and secure payment options. Learn how to set up the best online payment processes and safe ways to receive money online.

Why it’s important to accept online payments

Offering online payment options has become a necessity if you want to be a serious competitor in the digital world. Your users expect the flexibility to make purchases from the comfort of their homes and to choose which payment method is best suitable for their needs. Gain a competitive edge by supporting the demand and streamlining your own business operations at the same time. Accepting online payments also opens up opportunities for global customers and to reach international markets.

Explore different online payment methods

Give your customers the flexibility to pay however they prefer. SecurePay accepts a wide range of payment methods, offering you various options to choose the best way to receive payments from your customers.

Credit cards: Accepting major credit card payments can expand your customer base. SecurePay’s payment gateway supports popular card networks, ensuring smooth and secure transactions, including Visa, Mastercard, American Express, Diners Club and JCB.

Mobile wallets: With the rise of mobile devices, mobile wallets like Apple Pay have gained popularity. Integrating these options allows customers to pay using their smartphones.

Direct debit services: If you’re running a subscription service or charging ongoing fees, a recurring payment service could be the solution. With direct debits you can save money and time, and retain more customers too.

How to set up your online payment methods

SecurePay is an all-in-one solution to make it easier to accept online payments for small businesses and enterprises alike. Getting started with SecurePay is quick and easy, and works with any website type.

Payment gateway: Payment gateways transmit financial data between your website and the bank. Choose SecurePay to streamline your business transactions and make taking payments online a seamless process. From fast online transactions to enhanced data protection protocols – there are many payment gateway benefits.

Integration: Depending on your ecommerce platform, integrating the chosen payment methods might involve plugins or APIs. Ensure a seamless user experience during the checkout process and smoothly integrate SecurePay with ecommerce extentions such as WooCommerce, Adobe Commerce (previously Magento), OpenCart and PrestaShop.

Security: Security is key when accepting and receiving online payments. Your payment gateway should use encryption and fraud detection tools to protect both your customers' data and your business. Following the current global standards of online security, SecurePay keeps sensitive financial data protected through a number of security measures.

Customisation: Keep the checkout process as user-friendly as possible to help users make payments easily and quickly. Your customers should only need a few steps to complete a purchase. Customise the checkout experience to match your brand and create a trustworthy experience.

Testing: Thoroughly test the payment process before launching it live on your ecommerce platform. You want to be sure that the process for accepting online payments works as expected and taking payments online is running smoothly. SecurePay offers a "sandbox version", allowing you to freely test different scenarios for as long as you like before signing up for a live account.

Manage the online payment process

Once you are all set to accept online payments, it’s a good idea to review and oversee the payment process continuously. Stay on top of transactions with simple reporting tools, view and search your transaction history, process refunds and more. Using analytics tools and monitoring payments regularly also gives you insights into your conversion rates, trends and customer behaviours, all which you can use to refine the online payment experience for your business. Start accepting online payments with SecurePay and position your business for success in the global ecommerce market.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.