Payments

Trusted by over 90,000 Australian businesses

A product of Australia Post – SecurePay is an online payment service that is easy to integrate, flexible and secure.

NORA Solution Partner Award Best Payments Gateway 2022

These awards celebrate and recognise the achievements of suppliers and partners across the retail industry. The SecurePay team are honoured to win the award for "Best Payments Gateway" 2022.

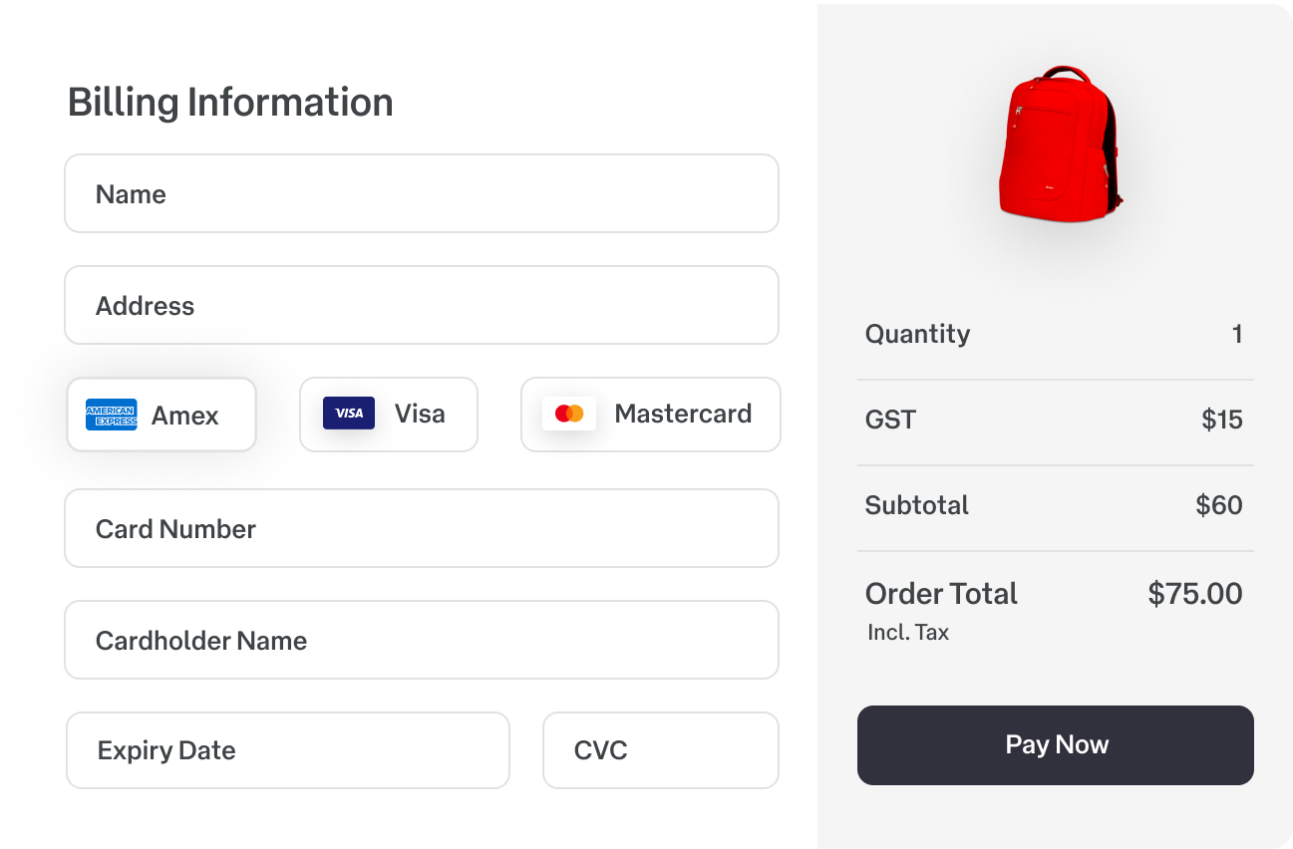

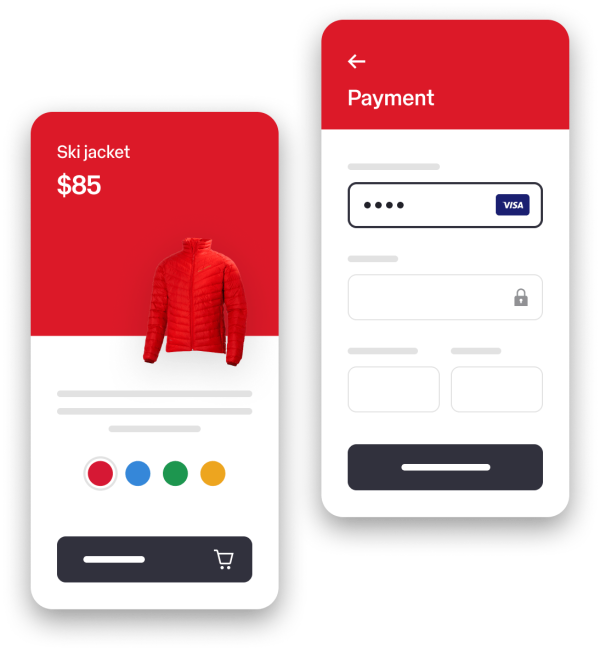

Online payments

Everyday online payments

Take payments online, view detailed reports and access local support. For simple everyday transactions, look no further.

New payments available

Now accepting Apple Pay

Apple Pay is a simple and secure way to pay with SecurePay.

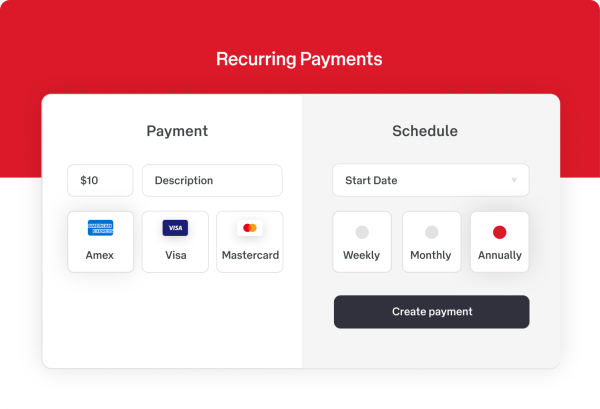

Subscriptions & Billing

Routine payments on a customisable schedule

Manage recurring payments by amount and frequency, and view detailed reports from your dashboard.

" We always find SecurePay's reporting to be accurate and it balances with our accounts department each month. "

James Rowett, Tennis Australia