Payments

Learn how to accept online payments with a payment gateway!

SecurePay enables you to accept payment and offers a payment system that matches your business needs - SecurePay is a flexible and secure online payment gateway solution 1.

Payment gateway pricing

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for its online payment gateway services.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Find the best online payment system for your business

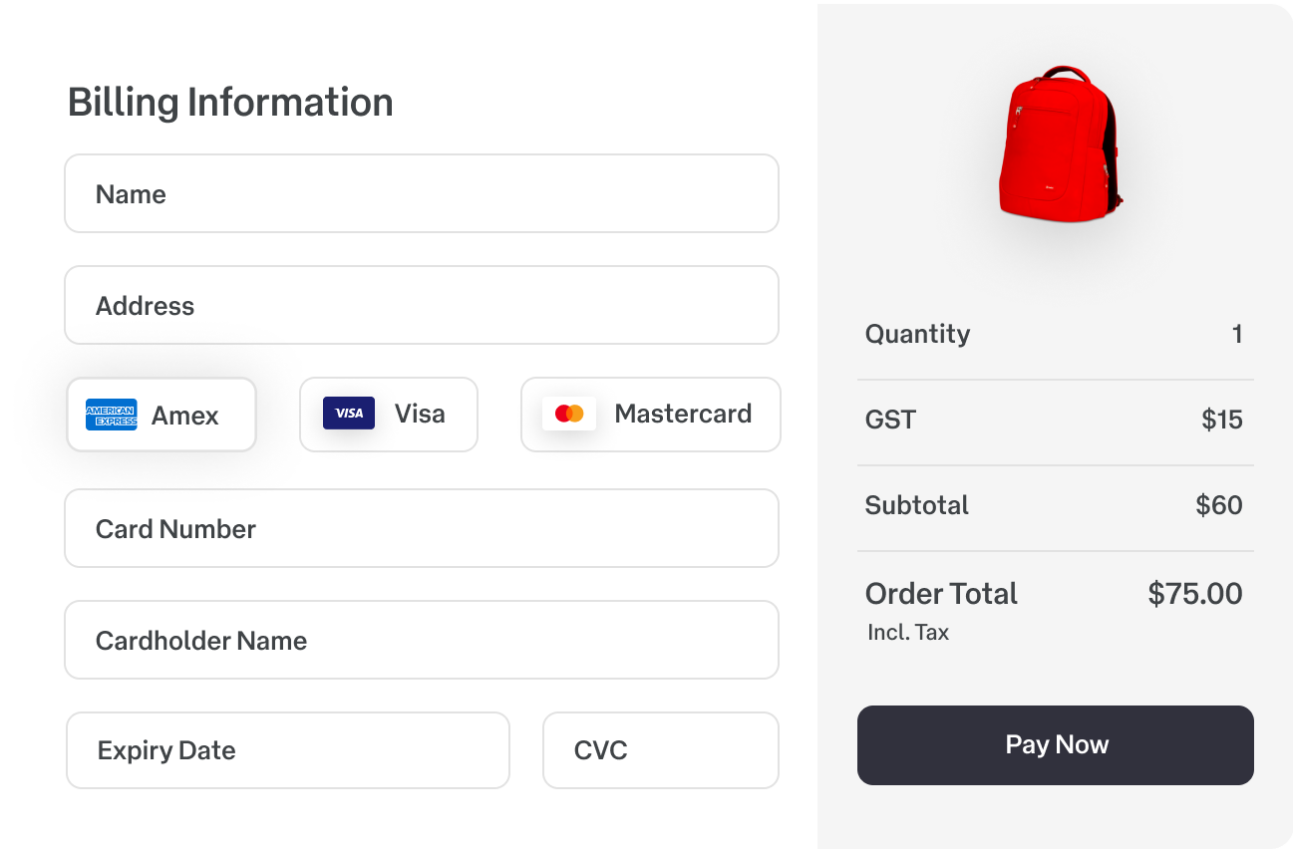

Set up an online payment gateway for your e-commerce store or online business. Access detailed reports and local support for everyday transactions.

All-in-one merchant and payment gateway solution

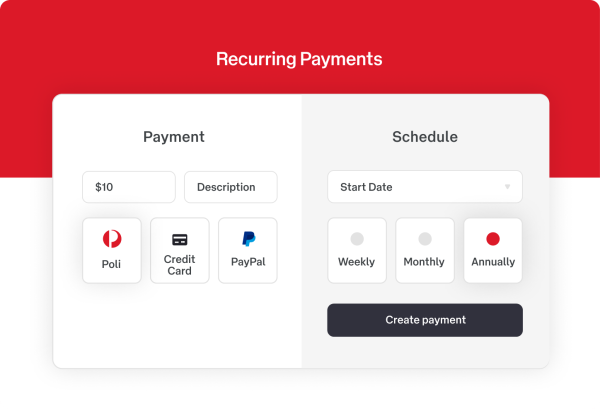

SecurePay’s internet payment gateway can also be used as a direct debit gateway or recurring payment gateway.

Ready to implement SecurePay’s merchant account and payment gateway?

How to accept online payments on my website?

Many people search how to accept credit card payments in Australia and how to process online card payments. The convenience and security of credit cards make them the most used online payment method.

What is an internet merchant account?

An internet merchant account is a special type of bank account, designed for online vendors who want to accept credit and debit cards online. A merchant account is an agreement between an online retailer, a merchant bank and payment processor.

What is a payment gateway?

An online payment gateway is an interface between your website and the service provider's servers and networks. It connects these together, enabling you to accept payments through your website in a secure and safe manner. In a sense, it’s the online equivalent to the card reader you might use to accept in-store payments.

How does a payment gateway work?

A payment exchanges information between your website and the customer's bank. In actual terms, the payment gateway works as a neutral third party between a business and its customers. It takes the money from customers when they make a purchase and then sends it to the business's merchant account.

Payment gateways execute a very vital part of online transactions. They authorise all the payments in a transaction between customers and businesses. You can think of a payment gateway as a banker that facilitates the exchange of money online as a neutral party between buyers and sellers.

A payment gateway codes all individual information and payment details. Credit card details, financial information, and other sensitive information are coded to allow it to be exchanged between seller and buyer without being visible to others.

Which online payment system is the best for your business?

There is a wide range of payment gateway providers, each with their own benefits, features and pricing options. Some payment gateway providers offer their own merchant accounts services. Other payment gateways can be linked with your own merchant account. It’s a good idea to compare a few options based on your specific business needs.

Besides credit and debit card payments, most payment service providers are compatible with one or more of the most common payment options such as BPAY, direct debit services, mobile payment options and phone payments (IVR). If you choose a payment provider, make sure to check if the payment provider offers your most favourable payment options.

Generally, you’ll have three main types of fees to pay: set-up fees, account fees and payment processing fees. If you take a low volume of online payments, then you should try to avoid monthly fees and high set-up fees. If you have a high volume, the transaction costs will make up the biggest part of your payment fees.

How to create a payment gateway on my website?

Are you aiming to set up an online payment gateway? Or are you trying to find out how to integrate payment gateways into your website? Obviously, the first thing to set up is your webshop. You can use third-party eCommerce software such as WordPress or Shopify.

Also, the software contains all the code for transferring payment information to the gateway. We do advise to use established software or work with a professional since creating this code from scratch can be challenging.

After connecting the payment gateway you can select the payment methods that suit your online business. Your payment gateway determines which cards are accepted. Generally, you will need to enter your payment gateway information for each method of payment you intend to accept.

Typically, your payment provider will provide a test or sandbox account. These allow you to perform fake transactions to ensure that the payment process is working.

A product of Australia Post - SecurePay is there to help you accept online payments and answer all of your questions, including questions regarding hosted and non-hosted payment solutions. SecurePay is a flexible, easy to integrate and secure ecommerce payment processing solutions provider.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.