Payments

Hosted vs non-hosted payment gateway solutions

Internet payment gateway for websites - SecurePay is a flexible and secure online payment gateway solution 1.

Great pricing for every type of payment gateway

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for all different types of hosted and non-hosted payment solutions.

Standard

1.6% +

$0.30 AUD

Domestic cards

3.4% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners or Apple Pay

Standard $25 chargeback fee

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

A payment gateway for every business

A suitable payment gateway for every business. A hosted or iframe payment gateway for your eCommerce store or a non-hosted payment gateway for your online business.

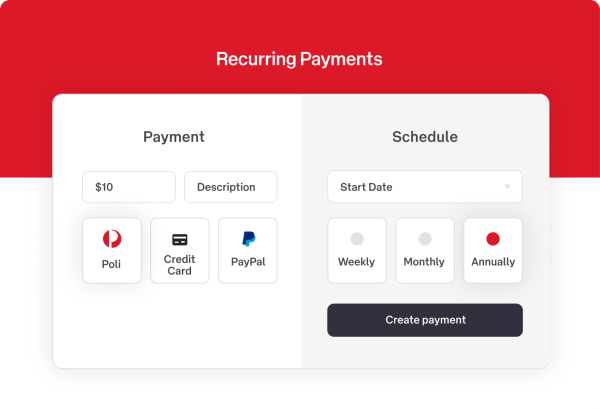

Multifunctional payment service

SecurePay’s internet payment gateway can also be used as a direct debit gateway or recurring payment gateway.

Ready to implement one of SecurePay’s payment gateway options?

Hosted vs Non-Hosted Payment Gateway

An online payment gateway is an interface that connects a business' website and the payment provider's servers and networks. When you are ready to implement a payment gateway, the hosted vs non-hosted decision is one of the most important considerations.

Hosted payment gateways are simpler whereas non-hosted payment gateways are more customisable. Globally, more than 50% of the payment gateway deployments are hosted 2. There are also semi-hosted payment gateway solutions. These are a combination of non-hosted and hosted gateways.

What is a hosted payment gateway?

Chances are you have come across the terms:

external checkout

third-party checkout

external payment page

off-site payment gateway

checkout page

These terms all refer to a hosted payment gateway. It is one of the most common ways to accept online payments.

A hosted payment gateway is a third-party checkout web form. It handles electronic transactions. In exchange for a transaction fee, the hosted payment gateway provider will take care of the entire transaction process. This includes payment information collection, sensitive data protection, and transaction security.

How does a hosted payment gateway work?

Hosted payment gateways direct your customer away from your site’s checkout page to the Payment Service Provider (PSP) page. Here the customer fills in his or her payment details. After the transaction is completed, the customer is redirected back to your website to complete the purchase.

Another way to integrate a hosted payment gateway is to use an iframe to embed the payment pages into your website. This kind of integration allows the buyer to proceed to the payment without leaving the purchase funnel.

The pros and cons of a hosted payment gateway

Hosted payment gateways can be considered the most convenient option. Hosted solutions are user-friendly and easy to set up and integrate with your website. Also, they require a smaller investment.

The most important argument against a hosted payment gateway is that you can’t control the whole user experience because it's managed externally.

Turnkey hosted payment gateways

A turnkey hosted eCommerce solution, also referred to as a “click and go” option, offers you everything that you need to set up your website and start selling online.

This solution can be a good fit if you are a startup or don't have very strong growth ambitions. However, a turnkey usually doesn't offer a lot of customisation options. If you grow your business, choosing a robust, scalable, customisable hosted payment gateway from the start, can save you a platform migration in the future.

What is a non-hosted payment gateway

While a hosted payment provider takes care of the hosting of the payment gateway, you do all of the hosting yourself if you want to deploy a non-hosted payment gateway. This type of payment gateway is also known as self-hosted payment gateway, a direct payment gateway, or an on-site payment gateway.

How does a non-hosted payment gateway work?

With a non-hosted payment gateway the payment details are collected directly on your website. The collected information is sent through HTTPS queries or by using the payment provider's API to process the payment.

The pros and cons of a non-hosted payment gateway

A non-hosted payment gateway is completely customisable and allows you to have full control of the user experience on your website. Your customers don't have to leave your website when making a purchase. Also, you have full control over your code and data.

As you have to handle the hosting portion entirely within your company. There’s a substantial expense of setting up the infrastructure that you’ll need for self-hosting. Usually, self-hosted gateways do not have a technical support team. You would have to hire an internal IT staff to manage and maintain that infrastructure.

SecurePay payment gateway

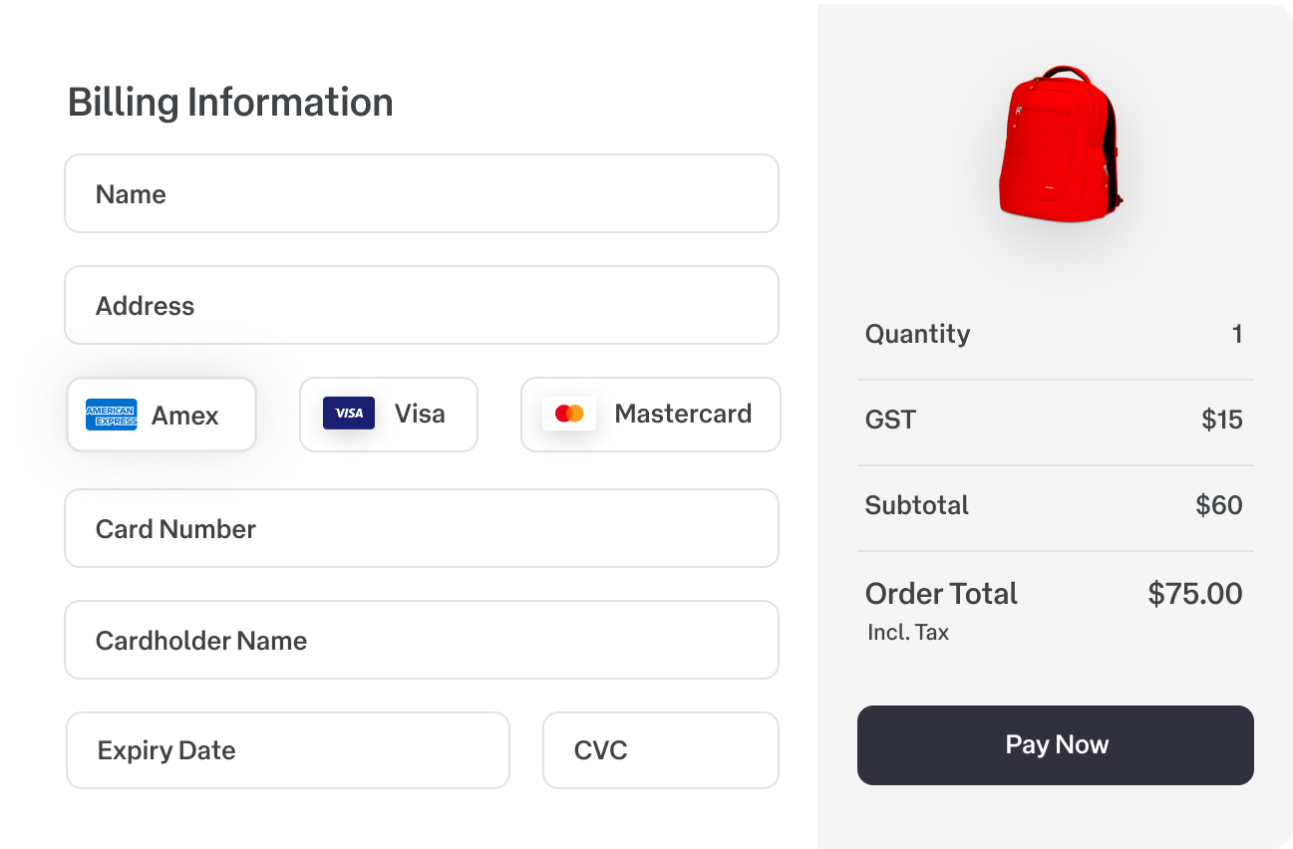

At SecurePay, we enable customisation of your checkout, offering both a hosted and non-hosted payment gateway. SecurePay's card payments UI allows you to maintain total control of your customer checkout experience without ever having to send customers away from your website.

A product of Australia Post – SecurePay is there to help you start accepting credit and debit card payments and to answer all your questions about payment services. SecurePay is an easy to integrate, flexible and secure ecommerce payment platform.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

2 Businesswire, 2018, https://www.businesswire.com/news/home/20180509005634/en/Global-Payment-Gateway-Hosted-Non-Hosted-Direct-and-Platform-Market-to-2025---ResearchAndMarkets.com

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.