Payments

Trusted online direct debit solutions

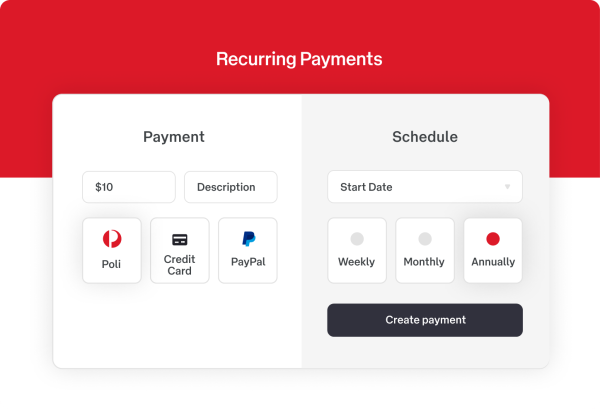

SecurePay offers a direct debit payment system, allowing your customers to make scheduled payments and enabling you to organise your direct debit management 1.

Direct debit payment system pricing

SecurePay uses a per-transaction pricing model for its online payment gateway. A transaction fee for direct debit transactions will apply.

Standard

1.6% +

$0.30 AUD

Domestic cards

3.4% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners or Apple Pay

Standard $25 chargeback fee

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Grow your business with direct debit payment solutions

An online direct debit system allows your customers to make regular payments from their bank account, ideal for subscriptions and payment plans.

All-in-one direct debit gateway

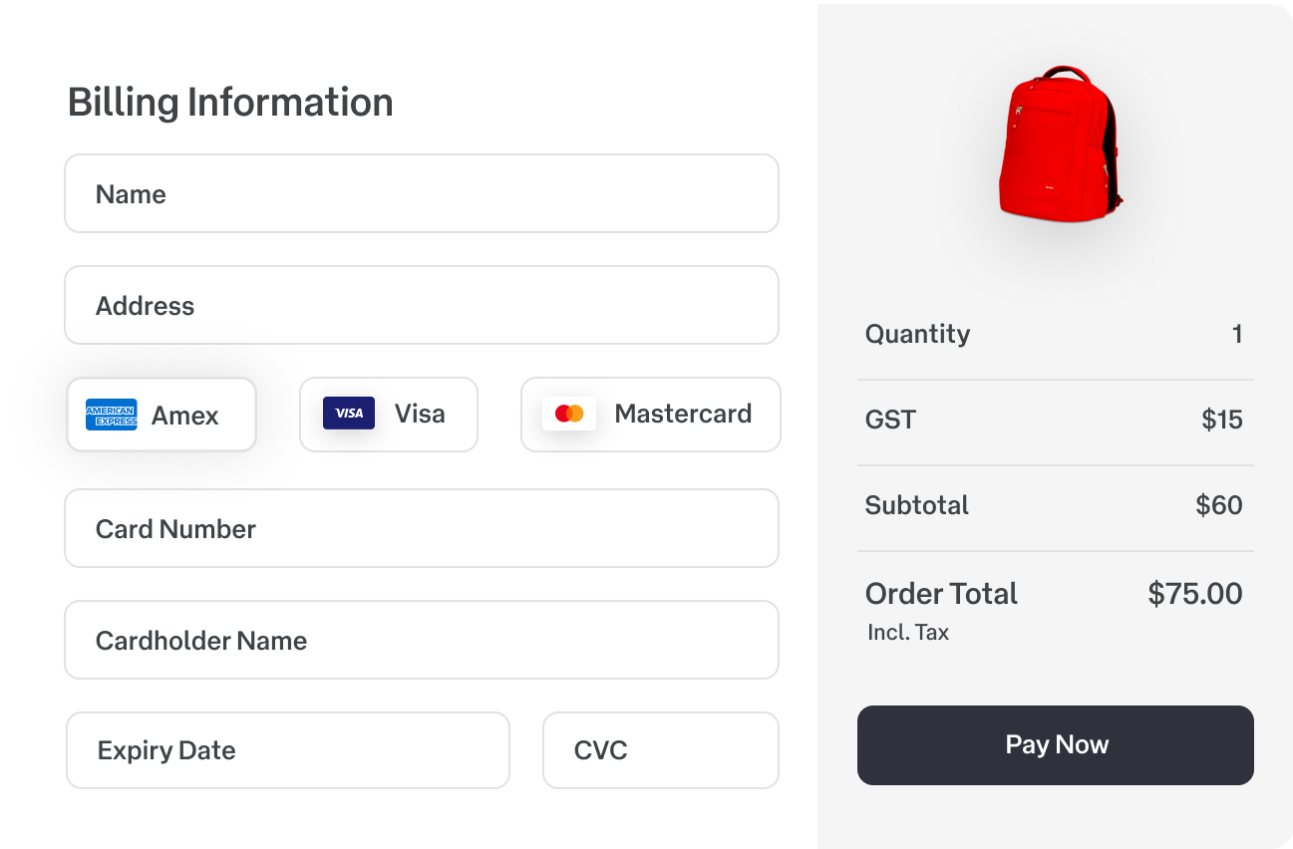

Are recurring direct debit payments only a part of your required online payment solution? SecurePay offers an all-in-one payment gateway, compatible with all major credit cards.

Ready to accept direct debit payments?

Accept direct debits payments

Direct debits are a tactic to save money, time, retain more customers and turn your inconsistent cash flow into predictable revenue.

The most important business benefits of a direct debit solution include:

Generate a steady and consistent cash flow

Convenient for you and your customers

Grow your revenue with new business models

Steady cash flow

Few things are worse than late or missed payments. Scheduled direct debit payments allow you to pull funds from any Australian bank and clear payments in a few business days. When you are able to get into a recurring payment relationship with your customers, an automated direct debit system is a fantastic way to improve your business’s cash flow. Predictable and secure cash flow is essential for more accurate planning, growth, and expansion.

Convenient

A direct debit payment system is a convenient way to receive payments. On the business side, no manpower is needed to track invoices or chase payments. Businesses that use a direct debit solution reduce their investment in admin by 20% on average.

On the other side, customers don’t have to approve payments or remember to make payments, which contributes to a stress-free payment process for customers. Customers are more likely to stay on board thanks to the convenience of automation. All good news for your customer retention metrics!

Grow your revenue

Do you think direct debit is not suitable for your business model? Maybe it’s time to reconsider your business model. According to a study of Zuora, 70 per cent of Australian and New Zealand businesses are planning to enter the subscription economy in the next two to three years. Potentially you can expand your services by accepting instalments to help customers spread out their cost or start offering subscriptions with additional services on top of your regular products and services.

How direct debit payments work

When you set up a direct debit with a customer, you can collect payments straight from their bank. Your customer fills out a mandate in order to authorise you to take payments from his or her bank. After filling in the direct debit form, the customer doesn’t have to do anything to make the periodic payment happen.

Obviously, you have to notify the customer ahead of time when you’re planning to execute a direct debit payment. When a payment is coming up, you send the customer a notice saying how much will be taken, and when. The customer doesn’t need to take any other action. When the due date comes, the payment is made automatically.

Why you should consider SecurePay’s direct debit solution

SecurePay is a product of Australia Post and is a trusted direct debit provider in Australia. SecurePay offers direct debit services for small businesses as well as for corporates. A few reasons to consider SecurePay as a direct debit provider:

Top grade digital security: PCI compliant and award winning security/anti-fraud solution

Local Australian support: Our Melbourne based support team are here to help 8am to 8pm Mon-Fri

Simple set-up and integration: We will work with any website type and provide detailed documentation

Multiple payment methods: SecurePay accepts a wide range of payment methods

By using a payment provider like SecurePay, you’ll be able to accept direct debits alongside a range of other features, including:

Reduce time spent chasing payments and bad debt with our automated re-billing for any failed payments

Simple reporting shows each and every transaction under the microscope, giving you a complete view of your transaction history

A complete solution for online payments, including a merchant account and a payment gateway that support scheduled as well as one-off payments

If you’re looking for a convenient way to start accepting direct debit payments, SecurePay can help. To find out more, simply get in touch with one of our friendly payment experts and we can help you get set up with direct debit payments today.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.