Payments

Trusted Australian online payment gateway

Internet payment gateway for websites - SecurePay is a flexible and secure online payment gateway solution 1.

Payment gateway pricing

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model for its online payment gateway services.

Standard

1.75% +

$0.30 AUD

Domestic cards

2.90% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners, PayPal or Apple Pay

Includes FraudGuard at no extra cost

Includes Dynamic Currency Conversion (International card fees apply)

Standard $25 chargeback fee

Receive a rebate on Dynamic Currency Conversion transactions

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

Everyday online payment gateway solution

Use our internet payment gateway for your e-commerce store or online business. Access detailed reports and local support for everyday transactions 1.

All-in-one Australian payment gateway solution

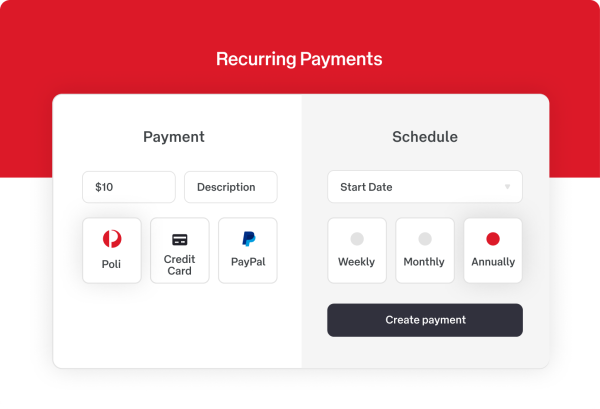

SecurePay's internet payment gateway can also be used as a direct debit gateway or recurring payment gateway.

Ready to implement SecurePay’s trusted online payment gateway?

What is a payment gateway?

A online payment gateway is basically an interface that works with a business's website and the service provider's servers and networks. It connects both these entities together, enabling the business to accept payments through their website in a secure and safe manner. E-commerce and mobile applications are becoming immensely popular with young consumers particularly and with their popularity, internet payment gateway solutions are also becoming popular. The ability to receive payment for products or services on a website is no longer a difficult task for businesses any more.

45% of Australian online shoppers claim that their preferred payment method for online purchases are credit or debit cards. An internet payment gateway is simply the code that links your webshop with your credit card. It allows the website to process the credit card information and ensures the payment is received. It works like a connection, through which online transactions can be moved automatically from the customer to the retailer.

With the help of payment gateway services, it becomes easy for websites to accept different types of online payments. Most online payment gateway solutions offer a complete payment solution. This means that instead of having to set up and run all the different interfaces, software, hardware, connections, and security yourself, the hosted payment gateway would do it for you. For many small-scale merchants, the ease of an internet payment gateway is a good way to gain access to e-commerce solutions.

How a payment gateway works

A payment gateway makes it possible for a website to accept a payment. It does this by exchanging information between the business website through any portal (this portal could be a website, mobile phone, or interactive voice response service) and the bank. In actual terms, the payment gateway works as a neutral third party between a business and its customers. It takes the money from customers when they make a purchase and then sends it to the business's account.

You can think of a payment gateway as an independent credit card or a banker that facilitates the exchange of money online as a neutral party between buyers and sellers. Payment gateway for websites can be offered by banks to their customers and they can also be offered by specialised service providers as a part of their value-added service portfolio like SecurePay does.

Payment gateways execute a very vital part of online transactions. They authorise all the payments in a transaction between customers and businesses. This means the effective performance of your payment gateway is vital to help build security and trust with your customers.

A payment gateway codes all individual information and payment details. Credit card details, financial information, and other sensitive information are coded to allow it to be exchanged between seller and buyer without being visible to others.

The basic steps of how it works:

Step 1

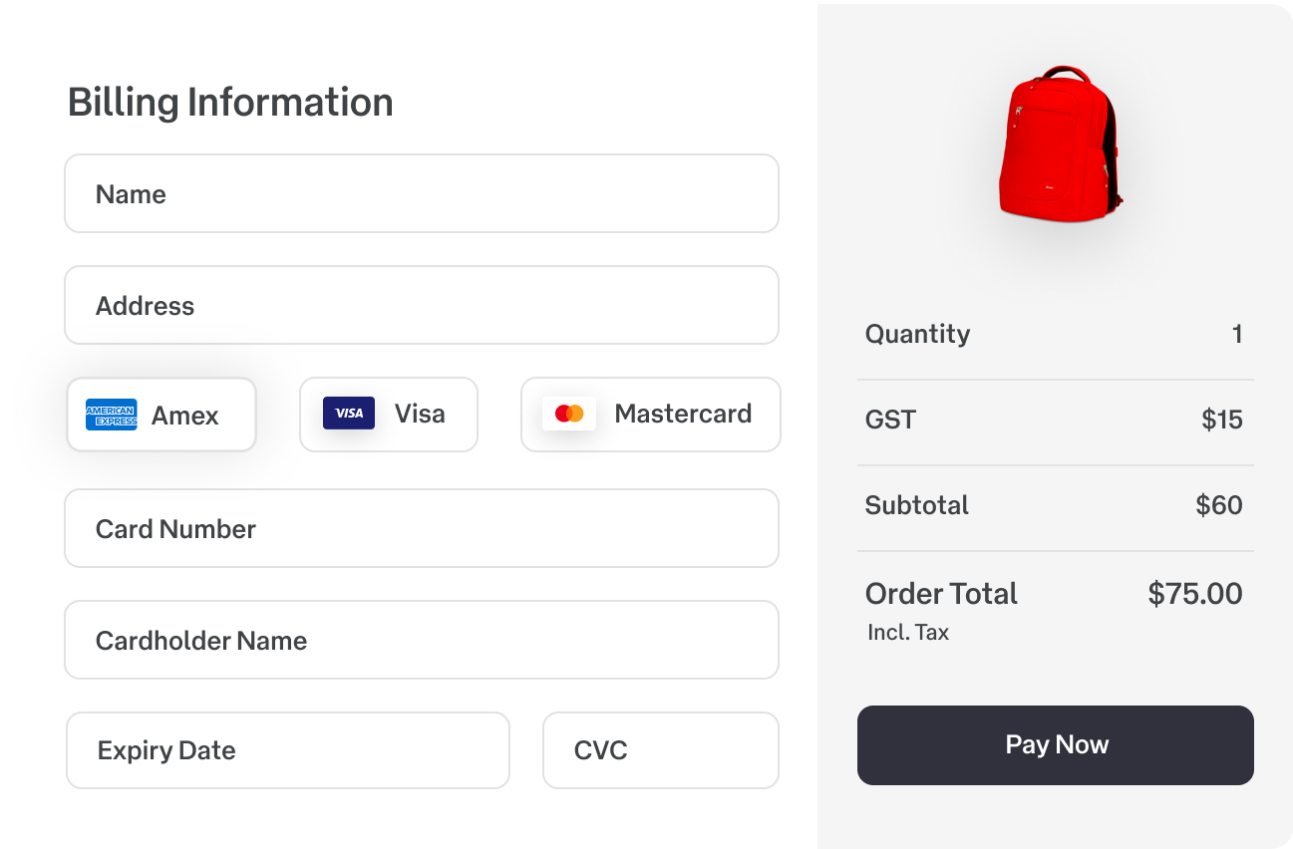

A form is given on websites for buyers to complete. All fields should be completed, particularly all the payment information. A preferred payment method is selected.

Step 2

A customer will create an order on the website that they are buying from, by either finalising the order, or checking out their shopping cart or basket. They would do this by pressing a relevant button on the web-site.

Step 3

Once the button is pressed, the website sends the order details to the payment gateway through a coded script. The buyer will then pay through the payment method that they have chosen earlier. The payment details are then sent either to the concerned bank or to the security page, where the buyer is requested to authenticate the transaction.

Step 4

If the buyer cannot authenticate the transaction, the payment gateway closes the transaction.

Step 5

Once the verification process is done, the transaction is then approved or declined. The main reasons for declining are usually failed verification or lack of funds in the customer's account. This information is given by the entity that has issued the customer's card, that is, by Visa, Mastercard, American Express, or any other card issuer.

Step 6

The Payment gateway informs the merchant about the transaction.

Step 7

The bank pays the money to the payment gateway

Step 8

The payment gateway then pays the due amount into the business's merchant account and adds the transaction to Visa/MasterCard for a settlement.

Step 9

The company that has issued the card pays the processing bank while taking the funds out from the card user's account.

A product of Australia Post - SecurePay is a payment service provider. SecurePay offers merchant services, including online payment processing, direct debit services and recurring payment solutions.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.